Finance

UYEGP Loan Apply Online: Get Upto 10 Lakh Business Loan

UYEGP Loan: If you are a youth and want to start a new business, then you will have to face many challenges, the biggest challenge of which is arranging money. Because no bank or NBFC gives loans to youth to start a business for the first time due to lack of experience, income stability, payment record, or lack of confidence.

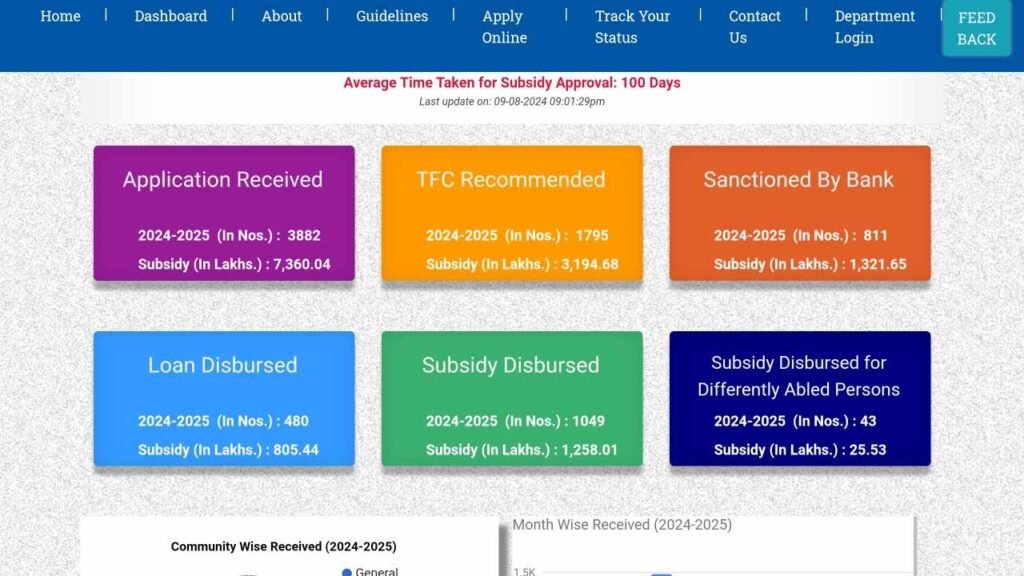

In such a situation, the Tamil Nadu government has started a loan scheme to promote small businesses, which will encourage unemployed youth to start their own business. The name of this scheme is UYEGP (Unemployed Youth Employment Generation Programme), under which the applicant will get a loan of up to 90% of the project cost.

If you want to know what UYEGP Loan Scheme is, how it works, and how to apply for it, then read this article till the end.

What is UYEGP Loan Scheme

UYEGP – Unemployed Youth Employment Generation Program is a Business loan scheme mainly launched for the unemployed youth of Tamil Nadu state. With the help of this scheme, any youth can take a loan to start a small business, provided he is a permanent resident of Tamil Nadu state. We can take a loan up to Rs 10 lakh from the UYEGP Loan Scheme.

If you take a loan from any bank or loan institution, you will have to pledge something. But to take a loan from the UYEGP scheme, you do not have to pledge anything. Through this scheme, you get a loan of up to 90% of the business project, and you have to pay the remaining 10%.

Under this scheme, you are also given a subsidy from the government, for which you will have to work on your business project after taking the loan. This is a very good scheme for the youth of Tamil Nadu through which any youth can start their own small business.

UYEGP – Unemployed Youth Employment Generation Program Overview

Important information related to UYEGP Loan Scheme-

| Full Name | Unemployed Youth Employment Generation Program (UYEGP) |

| Minimum Age For Application | 18 years |

| launch year | 2022 |

| Launch by | The Tamil Nadu State Government |

| Maximum Age For Application | 35 years (for general category)45 years (for special category) |

| Loan Amount | 90% of project cost (general category applicants)95% of project cost (special category applicants) |

| Educational Qualification For Application | 8th class pass or more educated |

| Beneficiaries Of The Scheme | Permanent resident of Tamil Nadu State for more than 3 years |

| Rate Of Interest | As per RBI guidelines |

| Repayment Tenure | Up to 5 years, will be fixed as per the bank |

| Applicant’s Contribution | 10% (General Category Applicants)5% (Special Category Applicants) |

| Project Cost | Rs. 10 lakh (Manufacturing), Rs. 3 lakh (Service) and Rs. 1 lakh (Business Projects) |

| Individual-Based Capital Subsidy | 25% of the Project cost (Maximum Rs. 3.75 lakh) |

| Official Website | www.msmeonline.tn.gov.in |

Features of UYEGP Loan

Some special features of the UYEGP scheme are as follows-

- Under this scheme, maximum beneficiaries will be selected at the district level.

- Under this scheme, the beneficiary will get a 90% to 95% loan of the business project.

- The interest rates of its loan are determined according to the Repo Rate set by RBI.

- After taking a loan from the UYEGP scheme, the beneficiary has to contribute 10% (special category) or 5% (general category).

- The applicant can take a loan for a maximum project cost of up to Rs 15 lakh.

- The lock-in period of government subsidy for this scheme is three years.

- You can repay the loan for 5 years, although this period will be decided by the bank.

Eligibility Criteria for UYEGP Loan Scheme

If you are an unemployed youth and you want to start your own small business, then for this you will have to fulfill the following eligibility conditions.

- To apply for UYEGP scheme, the applicant must be a permanent resident of Tamil Nadu state.

- To avail the benefits of this scheme, the age of the applicant should be minimum 18 years and maximum 35 years. However, if the applicant belongs to a particular category then their maximum age limit is 45 years.

- To apply for this scheme, the applicant must have passed at least 8th class.

- The annual income of the applicant and the applicant’s wife or husband should not exceed Rs 5 lakh.

- Any single person can avail the benefit of this scheme. But in this scheme no person can apply for loan in partnership.

- If the applicant has previously taken any loan or benefit from any other scheme then he/she will not be eligible for UYEGP.

Documents required for UYEGP Loan

To apply for the UYEGP scheme, you will need the following documents.

- Filled application form (online form) with the passport-size photograph.

- Applicant’s business project, detailing the total amount to be spent on the business

- Photocopy of the applicant’s educational certificate

- Separate applicant’s business plan

- Residence Certificate of the applicant

- Caste certificate of the applicant

- Apart from this, other important documents sought

How to apply for UYEGP Loan

If you are eligible for the Unemployed Youth Employment Generation Program (UYEGP) scheme of Tamil Nadu, then you can apply on its online official portal. You can apply for the UYEGP Loan Scheme by following the following steps.

- First of all, go to its official website “www.msmeonline.tn.gov.in”.

- After this, click on the Schemes option visible in the menu bar, and then select the option of UYEGP.

- Now you have to click on “Apply Online”, and then select the option “New Application”.

- Before applying you have to log in to the portal. If you have not registered before then click on the Register option.

- For registration, enter your name, date of birth, Aadhaar number, mobile number, email ID, password, and captcha. After this click on the “Register” button.

- Now you can apply, for which you have to provide some basic information, like email ID and educational background.

- After this, you have to upload the scanned photo in the prescribed size.

- Now you have to give information related to your business project.

- After filling in the information, you can see the list of uploaded documents.

- Click on the Continue button to proceed, after which you will get an application ID.

- Now you have to select the option of “Online Apply” of the Department of Micro, Small, and Medium Enterprises, and then select the option of “Upload Document”.

- To upload the document, you have to provide your application ID and click on the “Submit” button.

- After this, you have to upload your documents, and then submit your application.

- After the application is submitted, the officials will check and verify.

- If your application is accepted you will be called for an interview.

- If the applicant performs well in the interview then the officer will approve your loan.

- After this, your loan will be approved by the bank. Along with this, a letter will be sent to the applicant for EDP training.

- The applicant must also provide his/her EDP training certificate. Apart from this, the applicant will also have to submit an affidavit typed on non-judicial stamp paper of Rs 20.

- After this, you will receive an EDP letter for the training, after which you will have to attend those training sessions. You will also get a certificate after completing the training.

- Finally, the applicant has to submit the authentication to the bank, after which the loan will be given.

Financial Structure of UYEGP Loan Scheme for Small Business

UYEGP is a very good scheme for the youth of Tamil Nadu, in which the youth get the benefit of both loan and subsidy to start a business. Here I have given information about the economic nature of the total project cost in a table which is as follows.

| Category Of Applicant For UYEGP Loan | Applicant’s Plan In Total Project | Loan Amount | Subsidy |

| Special category applicants | 5% of total project cost | 95% of project cost | 25% of total project cost |

| General category applicants | 10% of total project cost | 90% of project cost | 25% of total project cost |

The following types of applicants are include in the special category-

- Scheduled Caste (SC)

- Scheduled Tribe (ST)

- Physically Handicapped

- Women

- Most Backward Class

- Backward Class

- Minority

- Former Serviceman

- Transgender

Note: On applying under this scheme, both loan and subsidy are jointly provided by the bank to the applicant. After this, the bank has to claim from the government to get the subsidy amount.

Benefits of UYEGP Loan Scheme

- The biggest advantage of the UYEGP Loan Scheme is that it will encourage Tamil Nadu youth to start their businesses.

- Under this scheme, unemployed youth will get a loan of 90% to 95% of the cost of the business project.

- After applying to this scheme, the applicant will have to contribute only 10% or 5% of the project cost.

- Under the UYEGP scheme, the beneficiary will get a 25% subsidy of the project cost in addition to the loan. This subsidy can be a maximum of Rs 2.5 lakh.

- The interest rates for loans available under this scheme will be decided as per the guidelines of RBI.

- The beneficiary of this scheme also gets the benefit of an Entrepreneur Development Program (EDP) course for seven days.

- Any applicant can take a loan under this scheme from various financial organizations including nationalized banks, private banks, and Tamil Nadu Industrial Cooperative Bank.

- The beneficiary of the UYEGP scheme is required to attend a seven-day Entrepreneur Development Program training course.

- Under this scheme, any applicant can take a loan without mortgaging anything.

- To ensure that more and more youth get the benefit of this scheme, buyer-seller meetings are also organized regularly.

FAQs – UYEGP LOAN

Q1. In which areas UYEGP Loan Scheme is applicable?

Ans. This scheme has been mainly launched for the state of Tamil Nadu. People from rural and urban areas of Tamil Nadu can avail the benefits of this scheme.

Q2. Can we take loan for existing business through this scheme?

Ans. No, through this scheme we can take loan only to start a new business. If you want to take a loan for your existing business, then you can approach the bank for regular business loan.

Q3. Is there any lock-in period in government subsidy?

Ans. Yes, there is a lock-in period of 3 years for the subsidy received under the UYEGP scheme. This means that the beneficiary of this scheme cannot exit the project until after three years from the date of receiving the government subsidy. But if the applicant exits the project before the expiry date then he will have to pay the amount of government subsidy as per the applicable rules.

Q4. What is the selection process for Tamil Nadu UYEGP Loan Scheme?

Ans. To take loan under this scheme, you will first have to apply online, after which you will be called for interview. After this, if you perform well in the interview then your loan will be approved. Note that you will also have to complete an EDP course. After this you will get the loan amount.

Conclusion – UYEGP LOAN

In this article, I have told about a great loan scheme of Tamil Nadu, named Unemployed youth employment generation program (UYEGP). This scheme is a very good scheme for the youth of Tamil Nadu, from which any youth can take a loan to start their business. Under this scheme, the applicant will get a loan of 90% to 95% of the project cost, in which the applicant has to contribute only 10% or 5%. Apart from this, the applicant also gets a subsidy of 25% under the scheme.

Therefore, this is a very beneficial scheme, through which the youth of Tamil Nadu can improve their future. Hopefully you have got complete information from this article. Please share this article with your friends who want to know about UYEGP Loan Scheme.